ROLE OF CRE IN M&A

Engaging in dialog with our experts will help your CRE teams, in supporting the wider organisation through the enormous changes and challenges presented by M&A. Technology is changing fast, and we’re keeping pace as the desire to enter into new and emerging markets, deliver new business lines and services, or create truly global and efficient scale has taken hold, M&A has become the strategy of choice. We’re leading the way adopting ground-breaking innovations that will bring exciting new technologies to your business and community.

Mergers and Acquisitions (M&A)

- M&A process may be viewed with fear or intimidation by CRE teams and that’s where our experts step in with a responsive, pragmatic contribution grounded in a real understanding of corporate strategies. Which then identifies and communicates real added value to the business, going a long way to achieving the strategic position that all CRE teams desire.

- We help Developers, Contractors, Service providers or Real Estate allied services companies refine their growth strategy, perform deal sourcing, conduct diligence and valuation, and implement M&A integration.

We provide what will transform the way you do business by enabling strategic growth through better integrated and operational mergers and acquisitions, JVs and alliances. We help Developers, Contractors, Service providers or Real Estate allied services companies refine their growth strategy, perform deal sourcing, conduct diligence and valuation, and implement M&A integration.

Typical Structure of a Business Combination Involving a Publicly Traded Real-Estate Owning Entity

- Enhancing up joint venture vehicles or equity, debt or quasi-debt investments in existing project companies for developing, constructing, or any other form of execution or implementation of a real-estate project (commonly used by strategic investors and private equity funds). Building a business transfer arrangements implemented by way of transfer of business undertakings or by way of court-approved mergers or demergers.

- Lending transactions by way of external commercial borrowings and rupee-denominated bonds issued overseas, or domestic loans. We use the choice of the above structures, in addition to achieving the commercial intent of the parties, also driven by the variable statutory and regulatory limitations of different states and sectors of India. We build real-estate projects which are typically developed and implemented through project specific special purpose vehicles (SPVs), which again typically are not publicly traded entities, a publicly traded real-estate owning entity can also explore any of the aforementioned options, subject to compliance with the securities regulations applicable to publicly traded companies.

- Commercial Real Estate, Europe accounts for some 40 percent of these deals. Manufacturing frenetic pace has only recently slowed as uncertainty around the full and lasting implications of the Pandemic prevailed. Contacting an increasing proportion, global M&A activity (45.5 percent) has been cross-border in geography like the Middle East, North Africa, India & the Southeast Asian markets, and this has fueled the emergence of truly global corporate occupiers across a range of sectors.

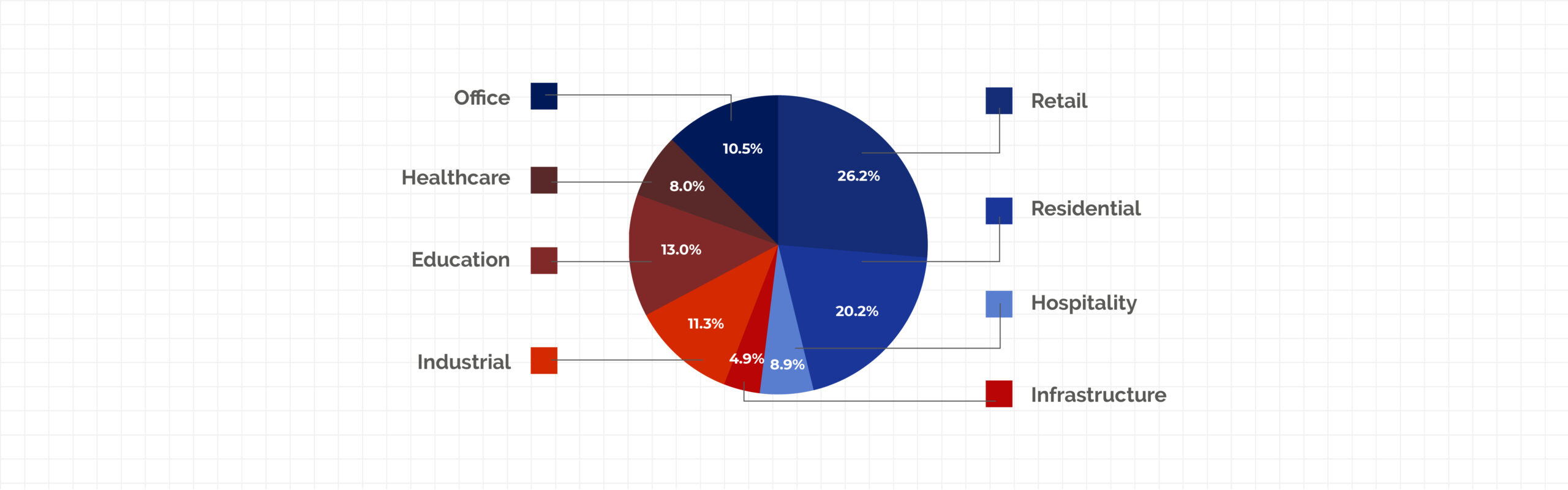

Portfolio Diversification

We’re always looking for ambitious, self-motivated practice of spreading your investments around so that your exposure to any one type of asset is limited which is called as Diversification. Join this practice which is designed to help reduce the volatility of your portfolio over time. The pathway to possible and successful investing is learning how to balance your comfort level with risk against your time horizon.

Invest too conservatively at a young age, and you run the risk that the growth rate of your investments won’t keep pace with inflation. Hardly, If you invest too aggressively when you’re older, you could leave your savings exposed to market volatility, which could erode the value of your assets at an age when you have fewer opportunities to recoup your losses.

One way to balance risk and reward in your investment portfolio is to diversify your assets is the new advancements. As businesses and communities move into the future, this strategy has many complex iterations, but at its root is the simple idea of spreading your portfolio across several asset classes. After years of experience owning and operating, we suggest, Diversification can help mitigate the risk and volatility in your portfolio, potentially reducing the number and severity of stomach-churning ups and downs. Approach diversification in a way which does not ensure a profit or guarantee against loss.